212-470-5630

OPTIMAL TAX SOLUTIONS INC

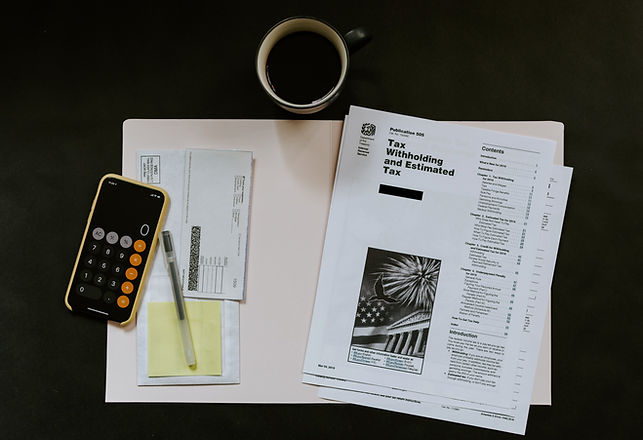

Tax Planning & Projections

Recognize and utilize the financial advantages accessible to you

Knowing how much you'll owe come tax time is a great advantage.

Knowing how much you can save yourself in taxes is an even bigger advantage.

Tax planning and projections helps you uncover these benefits that influence many long and short-term decisions that you make as a business owner. Optimal Tax Solutions INC strives to identify your opportunities, meet your challenges, and make clear the ultimate affect each decision will have on your company and its financial wellbeing. This includes identifying any tax adjustments or changes in the tax regulations that might alter your business or individual tax situation for the upcoming tax season. We help you avoid penalties and implement tax-saving strategies.

We recommend you book a one-on-one consultation to get started. This helps us help you!

Gain a more sophisticated financial picture of the bigger tax opportunities available.

We will guide through the following complexities, as well as others, depending on your individual circumstances:

-

Self-employment/ contractor/ freelancer income

-

Rental properties or personal new home purchase

-

Sale of Home or sale of other types of property

-

Equity Compensation. For example, RSU, ESPP, ISO, NSO, etc.

-

Moving of states or residency issues related to working from home away from your employer

-

Company IPO, merger & acquisition

-

Crypto currency

-

Foreign Income Exclusion & Foreign Tax Credit

-

Investment allocation

-

Business structure optimization

-

IRA, 401k, Roth IRA, and other investment strategies (or loans from these types of plans)

For Frequently Asked Questions,

and to gain more knowledge for yourself on the tax process

visit our

Additional Questions?

email us at info@optimaltaxsolutions.net